The impact of fiscal measures on reducing the budget deficit: analysis of the first package and outlook

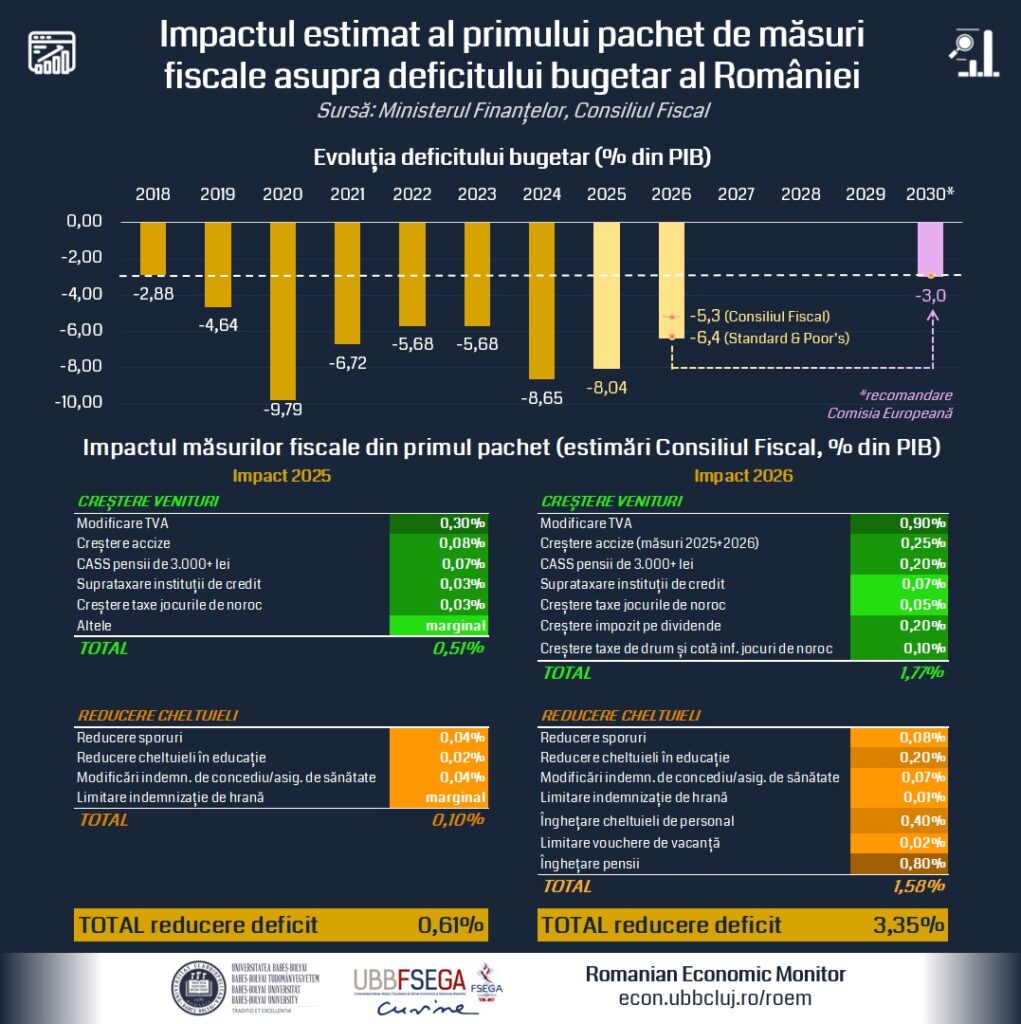

The first package of austerity measures came into force on August 1, 2025, with the aim of helping to reduce the budget deficit starting this year, with a more pronounced impact expected in 2026, when the measures will take effect throughout the entire fiscal year. Several estimates have therefore been published that are essential for a realistic understanding of the economic and budgetary situation and for outlining a credible path towards achieving the deficit target of 3% of GDP. It is worth noting that, during the process of drafting the first package of fiscal measures, the European Commission recommended that Romania correct its excessive deficit by the end of 2030, with the deficit falling below the threshold of 3% of GDP (the threshold for triggering the excessive deficit procedure within the European Union).

In July 2025, the Fiscal Council published an opinion on the draft law containing the measures in the first package. According to this document, the measures could lead to a reduction in the budget deficit by 0.61% of GDP, which would bring the deficit to 8.04% of GDP at the end of this year. Surprisingly, the largest rating agencies seem to be taking a more optimistic view, at least according to their latest public forecasts. Thus, Fitch anticipates a budget deficit of 7.4% of GDP in 2025, while Moody’s and S&P Global estimate a deficit of 7.7% and 7.8%, respectively. The latter seem particularly optimistic considering the Ministry of Finance’s August statement that the year-end budget deficit forecast “does not start with 7.”

In this context, forecasting for 2026 becomes even more difficult. According to the RoEM team’s analysis, based on publicly available information, estimates are again contradictory, but with opposite sign. The Fiscal Council estimates that the measures included in the first package could reduce the budget deficit by 3.35% of GDP, bringing the deficit to 5.3% of GDP in 2026 (starting from 8.65% in 2024). However, public debate and rating agency estimates are more cautious in this regard, with values generally exceeding the threshold of 6% of GDP. Specifically, Standard & Poor’s offers the most pessimistic estimate of 6.4%, while Fitch and Moody’s consider deficits of 6.1% and 6.3% of GDP, respectively, to be more realistic scenarios. It is also important to note that these estimates are based exclusively on measures from the government’s first fiscal package.

At the level of individual measures, the Fiscal Council’s estimates provide a clearer perspective on the necessity and impact of each intervention. According to these analyses, the VAT increase is the most significant measure on the revenue side: of an estimated total increase of 0.51% of GDP generated by the first package of measures in 2025, approximately 0.30% – i.e. almost 60% – is attributed exclusively to the change in VAT rates.

This high share will remain unchanged in 2026, when the impact of the new VAT rates will continue to be dominant. Although other fiscal measures included in the first package will also come into force on January 1—such as an increase in dividend tax, road tax, and gambling tax—the additional contribution to VAT revenue growth is estimated at 0.9% of GDP. Compared to this, the total impact of the whole package on revenue is estimated at 1.71% of GDP. So, the VAT increase will account for over half of the extra budget revenue generated by the measures in the first fiscal reform package in 2026.

On the expenditure side, the estimated impact of the budgetary measures for 2025 is relatively small, contributing to a reduction in public expenditure of around 0.1% of GDP. In 2026, however, this effect is projected to increase significantly, reaching 1.58% of GDP, with the most substantial savings coming from the freezing of pensions and public sector wages at December 2025 levels. On the other hand, even if some spending cuts seem modest as a share of GDP—for example, the reduction in education allocations is estimated at only 0.02% of GDP in 2025 and 0.2% in 2026—they can have a major impact on the area concerned. Thus, a reduction in annual expenditure of 0.2% of GDP in the education sector could be equivalent to a decrease of more than 6% in the total budget allocated to education (assuming a budget allocation of approximately 3% to education in 2026, similar to 2025), which could significantly affect the functioning of the sector.

Overall estimates indicate that the first package of fiscal measures was essential in preventing an imminent fiscal crisis: measures such as the increase in VAT and excise duties generated an immediate surplus of revenue for the state budget and contributed significantly to regaining the confidence of foreign investors in the country’s ability to manage this crisis. These measures will further support efforts to keep the budget deficit under control. However, current projections show that, in the absence of additional structural reforms, these measures will not be sufficient to reduce the budget deficit below the 3% of GDP threshold by 2030. Therefore, in addition to the urgent measures adopted in August, it is imperative to implement complementary reforms aimed at correcting the dysfunctions in the public and fiscal system, such as eliminating redundancies in the public administration, optimizing state spending, and eliminating unjustified tax exemptions. It is essential that these guidelines be incorporated in a consistent manner into the second and any subsequent reform packages in order to ensure the effective implementation of fiscal policies and to restore, in line with the commitments made, the medium- and long-term budgetary balance.