The delicate balance of Romania’s pension system: budgetary pressures and unfavorable demographics

The issue of public pensions has been at the center of economic and political debate in Romania for many years. The current system is a “pay as you go” system (the working generation contributes to the payment of current pensions), supplemented by a mandatory second pillar and an optional third pillar of private pensions.

In recent years, demographic pressures, an aging population, and rising social spending have forced the state to intervene through major reforms. In September 2023, the special pension regime was amended, and in November 2023, a comprehensive reform of public pensions came into force, aligned with the PNRR and the recommendations of the European Commission. The reform brings the recalculation of rights based on a points system, automatic indexation with inflation and wages, equalization of the retirement age between women and men (65 years by 2035), and a direct link to the evolution of life expectancy.

In this context, Romania is facing an increasingly difficult combination of rapid aging, massive labor emigration, informal work, and growing budgetary pressures. All of these factors questions the financial sustainability of the public pension system.

Evolution of expenitures and contributions

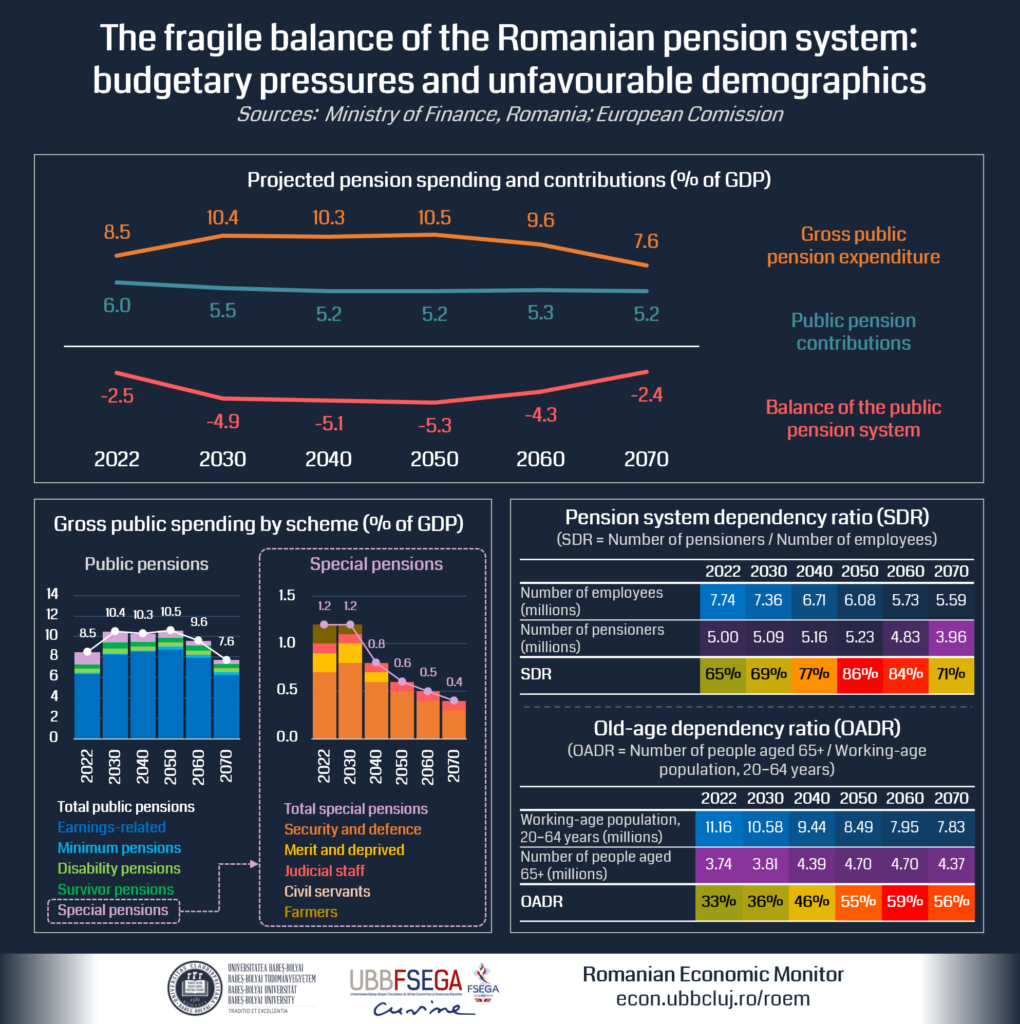

Gross expenditure on public pensions—including special pensions—accounted for approximately 8.5% of GDP in 2022. Projections in the report on population aging published by the Ministry of Finance in 2024 show an increase to 10.4% of GDP in 2030 and a peak of 10.6% in 2046. After this period, as a result of the 2023 reforms and population decline, expenditure would gradually fall to 7.6% of GDP in 2070.

On the revenue side, contributions to the public pension fund amounted to 6% of GDP in 2022, and are expected to stabilize around 5.2% of GDP between 2040 and 2070. The difference between expenditure and contributions has generated a significant structural deficit of 2.5% of GDP in 2022, which will deepen to 5.4% in 2047, before subsequently declining to 2.4% of GDP in 2070, thanks to reforms and a reduction in the number of pensioners, thus returning to the current level.

Fewer contributors, more retirees

The sustainability of a “pay as you go” pension system depends directly on the ratio between contributors and beneficiaries. In 2022, Romania had approximately 5 million pensioners in the public system and 7.7 million active employees (Eurostat). The Eurostat methodology includes self-employed persons and those working in the informal sector, and data collection is based on a sample of households instead of administrative sources. According to the National Institute of Statistics (INS) methodology, which is based on administrative data and includes only salaried persons (not self-employed persons, individual agricultural workers, or those working “off the books”), the number of employees is approximately 5.3 million.

By 2070, projections from the Ministry of Finance report on population aging point to a drop in the number of employees to 5.6 million according to Eurostat methodology (and to 4.2 million (!) according to INS methodology), as a result of emigration and a decrease in the working population, while the number of pensioners would fall to 3.96 million, against the backdrop of an increase in the retirement age. However, the dependency ratio remains high, as both categories are decreasing at a similar rate.

Thus, the pension system dependency ratio (SDR), calculated as the ratio between the number of pensioners and the number of employees, will increase from 65% in 2022 to 86% in 2050, then gradually decrease to 71% in 2070.

This rate paints an even bleaker picture if, in the denominator, we do not take into account all employees, but only those who pay contributions. In this case, the estimated dependency ratios for the system are 95% in 2030 and 97% in 2070. Technically, this means that one contributing employee would have to support one retiree from their contributions.

In other words, a shrinking working population will have to support a growing number of pensioners—a structural imbalance fueled by an aging population, declining birth rates, and massive labor emigration following EU accession.

Main challenges of pension system financing

- Adverse demographics

- Aging population: the proportion of people over 65 will increase from 33% in 2022 to approximately 55% in 2050 and 56% in 2070.

- Labor emigration: According to Eurostat and OECD statistics, approximately 20% of the active population works abroad, reducing the contribution base. Remigration remains uncertain, and local wages are not very competitive.

- Emigration of young people: according to a study conducted in 2024 by the Friedrich Ebert Stiftung Foundation, half of young people in Romania are considering emigrating to another country for a longer period of time.

- The communist-era baby boom: approximately 2 million people born between 1967 and 1969, in the immediate aftermath of the decree banning abortions, will retire after 2030, generating significant additional pressure.

- The labor market and limited contributiveness

- Low employment rate among mature working-age people: Romania has one of the lowest employment rates in the European Union. Early retirement remains attractive, and incentives to continue working are modest.

- Informal employment: tax evasion remains high, and a significant portion of the population does not contribute to the pension system.

- The migration of professionals: the departure of doctors, engineers, and other specialists reduces the average wage base and, implicitly, pension fund revenues.

- The structure of the system and special pensions

- Special pensions: although the 2023 reform reduced many privileges, certain categories (military personnel, magistrates, civil servants) continue to retire early and receive high pensions. The related expenditure amounted to 1.2% of GDP in 2022, and the 2023 reform provides for a gradual decrease to 0.4% of GDP in 2070. However, maintaining these differences affects the perception of fairness and trust in the system.

- Generosity of the scoring formula: pensions are calculated based on contribution points, indexed annually to inflation and 50% of the real increase in wages. In periods of high inflation, this mechanism risks leading to a faster increase in expenditure than anticipated.

- The role of private pensions: Pillars II and III

Pillar II, introduced in 2008, has a contribution of 4.75% of gross salary in 2024, scheduled to increase to 5% in the coming years. Over 8 million Romanians have contributed to the seven private funds, which manage a total of 166.2 billion lei (Reuters).

The authorities are preparing changes to limit cash withdrawals and introduce regular payments, in line with OECD membership requirements. In theory, pillar II should reduce pressure on the public system, but fund performance, market volatility, and low levels of financial education maintain public reluctance. Contributions remain too low to fully compensate for public pensions.

Pillar III (optional) is more modest – 680,000 contributors and assets of €865 million – with an estimated growth of 0.04% of GDP by 2070. Although tax benefits exist, the impact remains limited. For current pensioners, the state pension continues to be the main source of income.

Prospects professional life in the future

How long we will work and how long we will live in retirement are becoming key questions for Romanians. According to the report on demographic aging, professional careers will be extended, but post-retirement life will also be longer.

The average career length will increase from 35.4 years in 2022 to 39 years in 2070, mainly due to the 2023 pension reform, which gradually raises the retirement age for women to 65 by 2035, equalizing it with that of men. The new law also offers stability bonuses for those who work beyond the full contribution period.

The average length of retirement will increase from 18.3 years in 2022 to 24.6 years in 2070, as life expectancy rises to 83.3 years for men and 88.5 years for women. The effective retirement age will reach around 64 in 2040, with the restriction of early retirement and the introduction of higher penalties for early withdrawal.

Will we be able to live a decent life on our pension?

According to the report on population aging, the adequacy of pensions remains a major challenge. The ratio of average public pensions to average wages was 34% in 2022 and is expected to fall to 29% in 2070. Even more worrying is that the public pension replacement rate—the ratio between the first pension and the last salary—will fall from 36% to just 24% over the same period. In other words, according to this report, in 2070 a pensioner will receive, on average, a public pension equal to only a quarter of their last salary.

This reduction results from the strict application of the principle of contributivity and the elimination of certain advantages from the previous law.

Currently, over 16% of Romanians over the age of 65 are at risk of poverty or social exclusion—one of the highest rates in the European Union, according to OECD statistics. Declining replacement rates risk exacerbating this problem, even if recent reforms bring more generous indexation for small pensions.

Measures needed to strengthen sustainability

For a viable long-term pension system, coherent policies are needed in several areas:

- Increasing the employment rate: a more inclusive labor market that encourages working into older age can reduce pressure on the system. Incentives for employers and retraining for older employees are essential in this regard.

- Combating informal employment: stricter controls, digitization, and lower taxes on low wages can reduce tax evasion and thus broaden the tax base.

- Reform of special pensions: eliminating them or transforming them into a contributory system would improve social equity and save resources.

- Financial education: a culture of long-term saving would increase interest in private pensions, supplementing income in retirement.

- Efficient administration: digitizing processes, reducing bureaucracy, and conducting regular audits can cut costs and prevent administrative errors.

Conclusions

Romania has taken important steps to correct imbalances in the public pension system: automatic indexation mechanisms, equalization of retirement ages, and recalculation of entitlements.

The public pension system will come under enormous pressure in the coming years and decades—in other words, the public pension system deficit will increase significantly. More specifically, the public pension fund deficit as a share of GDP, is estimated to double by 2047. The situation will only improve after 2047, with the current level of funding imbalance returning around 2070.

At a time when Romania is facing rising public debt financing costs and a growing budget deficit, coupled with a doubling of the pension fund deficit, a double burden is being created: on the one hand, the state must try to increase revenues and reduce a number of budget expenditures, and on the other hand, it is facing a constant increase in social spending and financing costs.

In other words, even if the state budget was balanced at present, corrective measures would still be necessary to alleviate future pressures on the pension system. In the current context, however, Romania has the largest budget deficit in the EU, and in the coming years there will clearly be additional financing needs—firstly from the social protection system, and secondly due to the increasing costs of financing public debt.

Without additional measures, the financing of the pension system will continue to depend on massive transfers from the state budget—a burden that is difficult to sustain in a context of fiscal consolidation.

Unfavorable demographics, a fragile labor market, informal work, and the burden of special pensions are major structural challenges. To ensure long-term sustainability, Romania needs to continue reforms, boost labor market participation, reduce tax evasion, and strengthen private pension pillars.

Only through a combination of fiscal discipline and confidence in private savings can the pension system remain sustainable and guarantee a dignified old age for future generations.